Crisis Management Scorecard Is The Sure Way To Get Rid of Distressing Financial Situation

Current economic meltdown has no doubt impacted the entire economy of the world. Today thousands of companies and organizations have been suffering from recession. From financial institutions to banks, from corporate sector to government bodies and from non profit organizations to human protection groups, it has affected to almost everybody. That’s why we need a crisis management scorecard to get rid of these distressing circumstances. What exactly is crisis management scorecard? Well it is a financial measurement tool, which is efficiently used to overcome your declining economic circumstances. All you need to do is implement this tool so as to improve your financial situation smoothly.

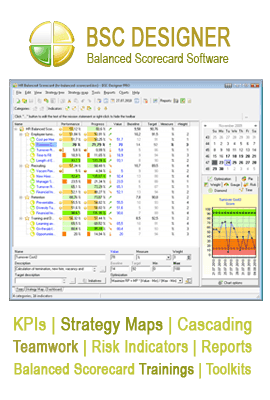

One of the significant points about crisis management scorecard software is its versatility and durability. Then it is very productive and also very cost-effective. Most importantly, it can be implemented in every organization or business. For example, these software applications can be proved as very handy and very effective for non profit organizations (NGOs), corporate sector, banks, printing industry, IT sector and all other sectors. On the other side, crisis management scorecard will help the companies to pay back their loans to the lender agencies on time. For that reason, it will not only diminish your debts burden but also improve your credit score significantly.

Another important perspective of crisis management scorecard is that it will not only diminish your mental stress but also give you a supreme financial stability. Then these software applications can be proved as very effective and very demonstrating during your credit risks and financial management plans. Besides, these would provide some handy guidelines to human resource managers to calculate your existing and past monetary trends effectively. That’s what it would help these managers to make strong decisions and better business planning regarding your lifelong business perspective. Last but not least, there are certain pros of crisis management scorecard software for instance timely removal of debts, improved credit report, financial autonomy, customer/employee satisfaction, increased sales proportions and business identity development.

In short, we can say that crisis management scorecard is truly amongst the cost-effective methods to get rid of your distressing financial situation effectively. In addition, it would provide plentiful benefits to the credit agencies on time. All you need to do is better understand the entire function of this software so as to evaluate your credit risks efficiently. Furthermore, you can implement some other types of software applications regarding your financial measurement plan. These may involve balanced scorecard, KPI, credit risk management and finance scorecard.