Controlling Performance during Economic Downturn through Recession Metrics

Controlling performance during economic downturn is a must to better deal with the effects of recession. Recession metrics should then be implemented to better handle the situation.

The recession that we are all experiencing and suffering from certainly has pretty much all of us on our toes – literally and figuratively. This is why controlling performance during economic downturn is a must and this should be prioritized by companies worldwide. Now, there have not been that too many set standards and forecasts in this arena because this recession is unlike any other that the world has gone through. Thus, this is just about the newest obstacle that the global economy has going on today. This is why it is extremely important to consider the implementation of recession KPIs or key performance indicators.

You might think that it would not be worth the risk to implement recession metrics or KPIs anymore because this period of recession might end anytime soon. Should it end, then the KPIs implemented would then be an unworthy investment altogether. However, you should not be worrying about that because this recession is not leaving us anytime soon, unfortunately, and this claim is supported by economic trends, stats, and figures presented by expert analysts. We are even quite far from the lowest point still. Thus, you should really consider implementing recession KPIs to deal with this economic downturn and control the performance of your enterprise.

How then should you begin the process of developing recession KPIs? The first step is actually one of the most important ones because it requires you to take a step back from your company and look at it from an objective perspective. This is a bit hard to do because you have been working in the enterprise for quite some time already. Still, you need to do this so that you can proceed to the next step.

The next step is to determine the possible causes behind all existing problems in your company. You have to look internally and externally for this so that all sorts of problems could be examined and analyzed. If you are not too sure about what problems to find, then look for signs – the qualitative and the quantitative. Quantitative ones can be in the form of declining market margins and increasing debts of the short-term kind. Qualitative signs, on the other hand, include high turnover – whether employee or manager – and the degradation of the company’s market value. With the company’s market value degrading, then it would not be too far off for employees and even clients to start looking for more reliable companies to do business with.

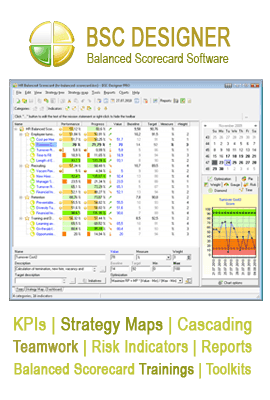

Next, you should determine if your IT systems are still effective. Look at the information that your existing IT systems are producing. Are they still relevant? Or do you need to modify your IT systems? And if yes, in what way? To do this, you can use business intelligence software to come up with the appropriate recession metrics.

The next step is to determine the necessary plans of action. For the most part, members of the senior management are the ones that would need to develop these strategies, as well as communicate these to stakeholders, investors, and the employees as well. All of these and more should be taken into account when developing recession metrics for the purpose of controlling performance during economic downturn.