Crisis Scorecards

With the economies tumbling down worldwide the nations are going through financial crunches and there prevails insecurity and crisis in almost all the business entities and the financial institutions. In such a scenario, when even the leading automobile industries are on the verge of bankrupting the importance in incorporating Balanced Scorecards within the organization slopes higher. They not only ease out the effects of recession to a certain extent but also help business entities to plan and structure approaches to make the best of the difficult times. Balanced Scorecards prevent financial disasters from occurring and wrecking entire corporations by allowing developing an aggressive defensive policy with holistic and cohesive methodologies.

One of the main reasons of the troubled organizations in the present is their negligence towards having a broader vision and focus towards the financial and other trends of the market, in order to avail the best returns in short term basis they failed to look at the brighter picture of the future. This is the reason the crisis management scorecards take into account all the perspectives that are or might affect or enhance the adversity of a situation.

The primary objective of the financial perspective in a crisis management Balanced Scorecards deals with sustaining the value of shareholders. These scorecards include metrics related to risk exposure. Evaluating the threat of a risk is important as sometimes potential risks can transform into prospective opportunities for the organization if tackled with acumen. However the measuring of risks is not that simple as each organization has its own set of defined standards, goals, and objectives.

Balanced scorecards allow the firms to take on a clear sense of their exposure by identifying the variables which are macro-economic in nature, which bear the greatest potential of harming a firm. Upon identifying this, they can be father scrutinized for the purpose of analyses and research in order to develop an apt course of action to be implemented.

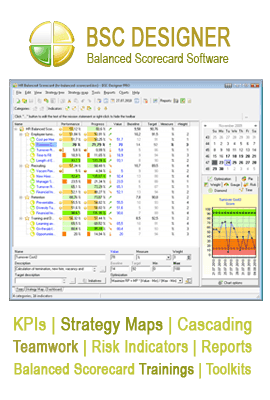

In the present time of crisis and recession, organizations are more interested in curbing their costs and garnering their revenues and profitability. Balanced scorecard is one of the most cost-effective measurement and evaluation tools that are available for use in virtually any activity – whether it is business-oriented or otherwise because of this Balanced Scorecards take into consideration all the aspects of an activity and deal with the results of each aspect in an effort to come up with an overall performance rating after all individual conclusions have been taken.

With the help of Key Performance Indicators involved in crisis management prompt results can be achieved in timely fashion with the help of their technological support. These KPIs are then combined into the strategic plans and approaches of the firm to be used by the company for the improvement of the management.